This copyrighted column - in part or in its entirety - may be freely shared among individuals, and it may be reprinted, republished, or quoted in any medium, including broadcast, cable, satellite, print, Internet, and other forms of media, but only when crediting Gary B. Duglin and The Controversy.

Donald Trump and his GOP cronies want people to believe - through misleading numbers - that the United States economy is in the best shape ever. Trump has made such a false declaration time and time again, including when he officially launched his 2020 campaign at a rally in Orlando, Florida on June 18th, 2019. "Our economy is the envy of the world. Perhaps the greatest economy we've had in the history of our country." Such a claim is categorically untrue. But I'll expound on that fact later in this column. Unfortunately, Republicans and a smattering of Independents nationwide have bought in to and accepted the deceit being thrown at them by Trump.

The unemployment rate may officially be at 3.6 percent, but just because someone is working doesn't mean they are not starving, and it doesn't mean they are able to pay their bills. With today's cost of living, the average person simply isn't making enough money to even "get by" without winding up in terrible credit card debt, while others - who can't qualify for a Visa, MasterCard or other such plastic - are having to struggle so much that not only can they not keep their head above water, they're being forced to pass on critical purchases such as healthy foods, prescription medicines, and other necessities that an American in the 21st Century should be easily able to afford by right...not by privilege. That said, with exorbitant interest and finance charges on credit cards, if you're simply paying the minimum each month, you're bound to end up losing your shirt, with bankruptcy as your only likely option. Debt experts, therefore, advise cutting up those cards before you get in to more financial trouble.

The unemployment rate is a fake figure anyway, as it truly doesn't provide the total truth. Let's say a person is laid off from his or her job after making an annual salary of $60,000. A year goes by and this individual is still unable to get hired and be paid a wage that is commensurate to his or her previous income. Desperate, the person accepts a position where the salary is only $30,000. It's a job so the individual is no longer considered "unemployed." But can that person really live - or support a family - on half the money he or she was earning twelve months earlier? Obviously not.

Wages have risen for some people, but not by much, which is certainly not enough. All Americans deserve to be paid more money, and no person should have to work more than one job. We are not on this Earth just to work. People must be able to enjoy life and have fun. It's a cliche, but it's true. "All work and no play makes Jack a dull boy." But the federal minimum wage rate is still only $7.25 an hour. Some retail outlets are paying as much as $10 or $11 an hour to start, but it's nowhere the amount needed for a person to survive. Even those Americans who currently earn $15 an hour can't get out of the hole from their past years of worse salaries. An hourly minimum wage of 15 bucks is the amount proposed by many Democrats, but that still is not an acceptable sum of money for anyone living in 2019 and the future.

Federal and state government officials also don't seem to consider that when a person does make $15 an hour their "take-home pay" is excruciatingly less once taxes and other required deductions are plucked away by Washington and your local political powers. But Uncle Sam and his 51 nephews only care about a person's gross income not the net. So when you multiply 40 hours a week by $15 an hour, that's $600 or a yearly gross salary of $31,200. It's still mighty difficult to weather the storms of fiscal life after FICA and the other taxes are withheld. It's almost impossible for a worker in that income bracket to do anything extra, let alone eat, pay rent, and meet other financial obligations. Believe it or not, $31,200 is $19,060 over the poverty level, which for individuals is a scant $12,140. So what if that same 31 grand is all the earnings for a family of four? It's $5,450 above the poverty guidelines. A two-spouse household with a couple of kids can't go over $25,750 in order to receive government assistance. How the hell does anyone think two parents can raise two children on such a small amount of money, whether $25,750 or $31,200? Federal officials have to start understanding that to provide a family - or even a single person - with a safe, better than decent place to live, food that's not going to create adolescent and adult blimps, healthcare for everyone, and all the other essentials to live, the dollars need to pile up in a mountain of cash that flows over the top like green volcanic lava. And if that same two-parent home doubles their income to more than $60,000, they're still not on easy street, as it's virtually impossible to exist without going in to serious debt.

A 2018 Federal Reserve study proves my points. The Fed says 39 percent of American adults couldn't, on their own, come up with $400 in an emergency. The survey says 27 percent would need to borrow the bucks or sell something to raise the needed funds, while 12 percent would be up the creek without a paddle, as they couldn't cover the nut at all.

Inequality.org is described as the "premiere portal" for anyone seeking "information and analysis on wealth and income inequality." According to the organization, "An estimated 43.5 percent of the total U.S. population (140 million people) are either poor or low-income," and "the official poverty rate understates the number of people in the world's richest country who have trouble making ends meet."

Despite all of the above, a July 2019 poll by The Washington Post and ABC News indicates that 51 percent of Americans approve of Donald Trump's handling of the economy. So given all the proof that the United States is not as financially sound as Trump, his administration, and Capitol Hill Republicans want us to believe, how do more than half the voting population of our country think Trump is economically doing right by them? Americans are being bamboozled by Trump as the economy is a much darker reality than the rosy picture he paints.

On top of everything else, Wall Street - not to mention stockholders from everywhere - have practically suffered nervous breakdowns over the last two years as the stock market has gone up and down like a Six Flags rollercoaster. But it's important to note that only about one-third of U.S. households own stocks of any magnitude.

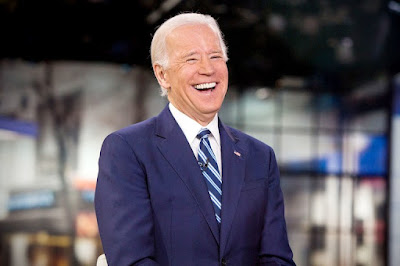

In 2016, I was all in and totally behind Hillary Clinton to become our nations 45th president. For 2020, I completely support Joe Biden. And as I did for Mrs. Clinton, I'm campaigning on Mr. Biden's behalf. These Democrats - as others have - speak the truth about economic inequality in America. According to Inequality.org, "Income disparities have become so pronounced that America's top 10 percent now average more than nine times as much income as the bottom 90

percent. Americans in the top 1 percent tower stunningly higher. They average over 39 times more income than the bottom 90 percent. But that gap pales in comparison to the divide between the nation's top 0.1 percent and everyone else. Americans at this lofty level are taking in over 188 times the income of the bottom 90 percent." In other words, the so-called "middle-class" are getting knifed in the back. I say the "so-called" middle-class because in reality there is no middle-class today. There are the super-rich, the rich, the comfortable but

careful, the people who barely squeak by, and the poor. Economist Edward N. Woolf - with data from the federal Survey of Consumer Finances - says, "The richest 1 percent of American households own 40 percent of the country's wealth."

careful, the people who barely squeak by, and the poor. Economist Edward N. Woolf - with data from the federal Survey of Consumer Finances - says, "The richest 1 percent of American households own 40 percent of the country's wealth." But Trump and the Republicans in Congress are greedy for even more. Thus, there's that Republican tax cut bill that Trump signed in to law back in December 2017. According to the Institute on Taxation and Economic Policy, as a result of the tax cuts, the richest 1 percent of Americans are expected - by the end of 2019 - to receive 27 percent of the benefits. Furthermore, the ITEP study shows that more than 50 percent of the tax cuts will help the top 5 percent of Americans, but the bottom 60 percent will get a mere 14 percent of the cuts. By 2027, some people - who don't make a whole hell of a lot of money to begin with - will pay more in taxes.

The Republican tax cut was a plan to give Donald Trump and his fat-cat billionaire buddies a way to put even more money in their already overstuffed wallets. It was never intended to help the majority of Americans. Oh sure, reports indicate that the legislation did help to take the unemployment rate below 4 percent, (an unrealistic figure as I explained earlier in this column), and the measure added about one point to the Gross Domestic Product growth. But many leading economists project that the economy is going to crumble like a stale Oreo as a result of the Republican's law, and that GDP growth will slow significantly to as little as 1.8 percent (or perhaps lower) by 2021. Of course Trump and his White House ass-kissers disagree with any such forecast.

America's economy is actually killing people. According to the Centers for Disease Control and Prevention, the adult and childhood obesity rates in the United States have skyrocketed. Logically, individuals and families have little or no choice but to buy foods that are high in carbohydrates and fat content. A box of spaghetti - costing roughly a dollar - can feed a person dinner for at least four separate evenings. All those carbohydrates will fill up the tummy, but carbs turn to sugar and, therefore, calories. Those calories quickly pack on the weight. Two doughnuts for breakfast every morning will also satisfy your hunger, and for a buck it won't break your bank. But those sweet treats will add more pounds to your belly or butt. As a result, cholesterol and triglyceride levels will soar in to the danger zone and lead to heart troubles, strokes, and other health problems...including the possibility of death. So Trump's tax law is also making money for hospitals, doctors, pharmaceutical companies, and - at times - even funeral homes and cemeteries.

As people continue to not earn enough money to eat properly, they will get fatter and fatter. The CDC says, "In the United States, the percentage of children and adolescents affected by obesity has more than tripled since the 1970s." Data by the CDC shows that "nearly one in five school-age children and young people (6 to 19 years)" are obese. The CDC statistics also indicate that the prevalence of obesity is 39.8 percent and affects about 93.3 million U.S. adults.

So what's the answer? Elect a Democrat to the presidency.

I mentioned earlier in this editorial how Donald Trump has lied over and over again when he claims that the U.S. economy - under his watch - is the "greatest" in history. But it was President Bill Clinton who finished his two terms in office (January 1993 to January 2001) by leaving our country in the best economic condition with the biggest economic growth

since January 1969 when President Lyndon B. Johnson made his exit from The White House. No president since President Clinton has even come close to what our 42nd President achieved. Those statistics are factual according to the Bureau of Economic Analysis.

Mr. Clinton was president at a time when the United States had the longest boom in history. His success followed the fiasco of President Ronald Reagan's "trickle-down economics," also known as "Reaganomics," which his vice-president continued when he succeeded Mr. Reagan and became President George

Mr. Clinton was president at a time when the United States had the longest boom in history. His success followed the fiasco of President Ronald Reagan's "trickle-down economics," also known as "Reaganomics," which his vice-president continued when he succeeded Mr. Reagan and became President George H. W. Bush. The public policy research and advocacy organization, Center for American Progress, states with certainty and proof that "trickle-down tax cuts don't create jobs. And, trickle-down tax cuts have consistently failed to benefit working families." In 1993, President Clinton raised taxes on the wealthiest of Americans - the top tier earners - from 31 percent to 39.6 percent. As the Center for American Progress notes, "Conservatives predicted disaster. Instead, the economy boomed." While President Clinton sat behind The Oval Office desk, a record 22.7 million jobs were created and

the economy grew for 32 consecutive quarters. But in 2001, when President George W. Bush took office after President Clinton, Mr. Bush drastically cut income taxes for the very rich, and by 2008 the United States had deteriorated in to an economic collapse. The "Bush 43" tax rates remained through 2012 until President Barack Obama was able to bring the nation back to that 39.6 percent rate, and also hike up the tax rates on capital gains and dividends. As the Center for American Progress reminds us, once again "conservatives predicted doomsday." However, the economy took off in leaps and bounds, growing steadily.

If Donald Trump had followed in President Obama's footsteps, we'd be moving forward, not backward, as is being projected for 2019, 2020, and 2021. America was headed towards long-term success with President Obama. With Donald Trump, we're on our way to an economic catastrophe.

Think about what it costs you today to fill up the tank in your car with gasoline. Oil prices declined during President Clinton's tenure with gas prices at the pump dropping to 95 cents a gallon. Remember this though...while President Bush 43 was in The West Wing, gas stations in some parts of our country were charging between $4 and $5 a gallon. Today, we're on the rise again. AAA says the cost of gas has increased to a national average of $2.75 a gallon. But, as this column is published, the station I frequent is selling regular gasoline for $3 a gallon.

Donald Trump can't - and will never - accomplish what President Clinton did. The non-partisan Congressional Budget Office confirms that each year under Mr. Clinton the federal budget was balanced and the federal deficit was erased. Some of you might be asking what the difference is between the federal deficit and the federal debt. FactCheck.org explains, "A deficit occurs when the government takes in less money than it spends in a given year. The debt is the total amount the government owes at any given time. So the debt goes up in any given year by the amount of the deficit, or it decreases by the amount of any surplus." The bottom line is that President Clinton was largely responsible for a very robust economy during his presidency. And when he handed over the keys to the front door of 1600 Pennsylvania Avenue to President Bush 43, Mr. Clinton bid farewell with a surplus.

Donald Trump criticizes President Obama for his economic policies. But it was Mr. Obama who took the United States in to a pathway for prosperity after the worst economic crisis our nation has seen since The Great Depression. And the fault of what is known as The Great Recession lies primarily on the shoulders of President George W. Bush. Today, Trump wants to pat himself on the back for our current economy. The Washington Post says Trump - since early 2018 - has been labeling America's economy "the best ever." But The Fact Checker of The Washington Post has documented more than 10,000 false or misleading claims since Trump took the oath of office on January 20th, 2017. It is widely thought that Trump is a pathological liar. I disagree. Healthline.com defines a "pathological liar" as someone who lies "for no apparent reason." Trump does have a reason when he lies. I'm convinced his lies are deliberate. Trump is devious, unethical and immoral. His habitual lying is always - in some way - to benefit himself. The Washington Post says dozens of Trump's lies have been about the U.S. economy. But why not? After all, he's chronic. Trump lies about everything.

And that's The Controversy for today.

I'm Gary B. Duglin.

"We'll talk again."

The Controversy is a publication of GBD Productions. Founder and Editor-In-Chief of The Controversy is Gary B. Duglin.

Please express your personal opinions by following the instructions printed at the top of this column. And thank you for reading The Controversy.

Photo credits: John Raoux/The Associated Press (Donald Trump #1), Scott Eisen (Former Secretary of State Hillary Clinton), Nathan Congleton/NBC News/NBC Universal Photo Bank and Getty Images (Former Vice President Joe Biden), New York University (Edward N. Wolff), Karl Gehring/Getty Images (Former President Bill Clinton), Pictorial Press (Former President Lyndon B. Johnson), Michael Evans/Creative Commons and Getty Images (Former President Ronald Reagan), Luke Frazza/AFP/Getty Images (Former President George H. W. Bush), Mandel Ngan/AFP/Getty Images (Former President George W. Bush), Pablo Martinez Monsivais/The Associated Press (Former President Barack Obama) and The Associated Press and Getty Images (Donald Trump #2)

Copyright 2019 Gary B. Duglin and The Controversy.net. All Rights Reserved.

Gary, one point, you stated “as a result of the tax cuts, the richest 1 percent of Americans are expected - by the end of 2019 - to receive 27 percent of the benefits” so you are agreeing that the top 1% got short changed, they make 19.72% of the income and pay 37.32% of all Federal Income Tax yet they only got 27% of the tax cut benefit. Isn’t that a little unfair, earn under 20%, pay over 37% and only get 27% of the benefit. The bottom 50% only pays 3% of all Federal Income Tax yet they are getting 17% of the tax cut benefits, so who got a better deal and who got screwed? How much of someone’s money should the government be allowed to steal? The federal government needs to cut spending and cut taxes, the federal government shouldn’t be paying for schools, or health care, or if you build a town below sea level and then the rain comes and floods it, that’s not the Federal Governments job to rebuild it, it is your state and local governments job, more so it is your problem you built it below sea level now you have to rebuild, hope you got “private” flood insurance.

ReplyDeleteJust to say one last thing, your statement “the fault of what is known as The Great Recession lies primarily on the shoulders of President George W. Bush” is a flat out lie, we had 9/11 that started it and of course the left pushing and threatening banks to make billions of dollars’ worth of home loans knowing the people couldn’t pay the back, they called the banks racist and that they were redlining areas because of race, no it was because the people in those areas couldn’t pay the loans back!! Don’t blame President Bush, he was a far better president than Obama ever was.

The response to the above reader will be in three parts.

DeletePART ONE OF THREE

Wayne, the top 1 percent should not be receiving any tax cuts. That's why - in the past - Democratic administrations raised the tax rates so that they were much higher for the top 1 percent.

The federal government should pitch in and be responsible - along with states and cities too - for "schools" and "healthcare" and "floods" plus whatever else may be critically necessary.

GBD

END OF PART ONE OF THREE

PART TWO OF THREE

DeleteAs for The Great Recession, it is not a "flat out lie" to blame President George W. Bush. Your defense is not accurate. And if you're blaming 9/11 for the economy, let's not go there, because you know my feelings - as I have written in the past - that the truth of the matter is, if President Bush had listened to his counter-terrorism chief, Richard A. Clarke, there probably would not have been an attack on our country on September 11th, 2001. The following is directly from Wikipedia.

"In his memoir, Against All Enemies, Clarke wrote that Condoleezza Rice decided that the position of National Coordinator for Counterterrorism should be downgraded. By demoting the office, he believed that the Administration sent a signal to the national security bureaucracy that reduced the salience of terrorism. No longer would Clarke's memos go to the President; instead they had to pass through a chain of command of National Security Advisor Condoleezza Rice and her deputy Stephen Hadley, who bounced every one of them back. 'Within a week of the inauguration, I wrote to Rice and Hadley asking 'urgently' for a Principals, or Cabinet-level, meeting to review the imminent Al-Qaeda threat. Rice told me that the Principals Committee, which had been the first venue for terrorism policy discussions in the Clinton administration, would not address the issue until it had been 'framed' by the Deputies.' The National Commission On Terrorist Attacks Upon The United States reported in its eighth public hearing: Clarke asked on several occasions for early principals meetings on these issues and was frustrated that no early meeting was scheduled. No Principals Committee meetings on al Qaeda were held until September 4th, 2001. At the first Deputies Committee meeting on terrorism, held in April 2001, Clarke strongly suggested that the U.S. put pressure on both the Taliban and Al-Qaeda by arming the Northern Alliance and other groups in Afghanistan. Simultaneously, he said that the US should target bin Laden and his leadership by restoring flights of the MQ-1 Predators. Deputy Secretary of Defense Paul Wolfowitz responded, 'Well, I just don't understand why we are beginning by talking about this one man bin Laden.' Clarke replied that he was talking about bin Laden and his network because it posed 'an immediate and serious threat to the United States.' According to Clarke, Wolfowitz turned to him and said, 'You give bin Laden too much credit. He could not do all these things like the 1993 attack on New York, not without a state sponsor. Just because FBI and CIA have failed to find the linkages does not mean they don't exist.' Clarke wrote in Against All Enemies that 'in the summer of 2001, the intelligence community was convinced of an imminent attack by al Qaeda, but could not get the attention of the highest levels of the Bush administration.' At a July 5, 2001, White House gathering of the FAA, the Coast Guard, the FBI, Secret Service and INS, Clarke said that 'something really spectacular is going to happen here, and it's going to happen soon.'"

So yes...I do blame President Bush, Condoleezza Rice, Stephen Hadley, Paul Wolfowitz, and others who were in the loop in the Bush administration for not being more diligent in preventing 9/11.

GBD

END OF PART TWO OF THREE

PART THREE OF THREE

DeleteAs for your comment that President Bush (43) was "a far better president than Obama ever was," President Barack Obama has been named the "best" president in modern history. The following is direct from ABC News, but similar stories were published by all the major television networks, newspapers and magazines throughout the country.

"A Pew Research Center poll says more Americans rank former President Barack Obama higher than any other when asked which president has done the best job in their lifetimes. Obama was named the best or second best president by 44 percent of Americans in the survey. Thirty-one percent ranked him as the best president in their lifetimes." President Bill Clinton was ranked second and President Ronald Reagan came in number three on the list. Way down in the survey was President Bush 43, who only received 10 percent support as being the best. I rest my case.

GBD

END OF PART THREE OF THREE

Reply to your part 1: Why shouldn’t the top1% or even top 10% get their fair share of the tax cuts they pay the highest rates and pay almost 70% of personal Federal Income tax is paid by the top 10%? The bottom 50% only pay 3% of the tax burden, tens of millions pay nothing and even worse millions get refunds after paying nothing. How can you get a “refund” when you never paid anything? Very unfair! Why should the Feds pay for local schools and other things that are state and local issues? I’ll say it again to you as I have many many times, read the US Constitution, the 10th Amendment “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

DeleteReply to part2: I must say you once again proved yourself as a hateful and partisan hack for the lies you stated about President Bush. Your lies have been disproven by the 911 commission’s report. The so called intelligence was about possible hijackings, the President ordered the FAA in July 2001 to increase security, the FAA issued warnings to all airlines advising that "terror groups are known to be planning and training for hijackings." In August 2001, President Bush receives a CIA report about al Qaeda and the possibility of airline hijackings. The report was passed on to US Embassies and other overseas facilities. Later in August the Administration had the FAA issue an alert about "disguised weapons." All airlines were alerted that terrorists might use common objects such as cell phones or clothespins or other items as weapons. The FBI, State Department, Customs and INS were all notified about the CIA’s concerns about Nawaf Alhazmi and Khalid Almihdha, all agencies were on alert and searching for them. President Bush did his job! Stop the lies. Stop believing a proven disgruntled liar, Richard Clarke, he is a liar and a hater, it has been proven!

Reply to part 3: I believe history will show how great G W Bush was as a President and how destructive President Obama was to America. Obama’s terrible tax policies, giving billions of dollars to the terrorist country of Iran, the Iran nuclear deal which put Israel, America and the rest of the world at risk. His apology tour, his jumping into every issue he could and blame it on race, blaming white police (in some cases people of color that were police) before he knew the facts, if the issue was between a black person vs a white person he always made it that the white person was at fault and it was because all whites are racist. Not to forget the ACA , remember the lies you can keep your doctor or you can keep your plan, your plan will go down by $2500, all lies. Millions lost their plans and their doctors and their cost went up with premiums, deductibles and co-pays over 150% some went up 200-250%, lies, lies and more lies! The list goes on and on but I think you get my point.

Wayne, read what I wrote again. I said "the top 1 percent should not be receiving any tax cuts." I said nothing about the "top 10 percent."

DeleteHere's the simple answer to your rhetorical question - "How can you get a 'refund' when you never paid anything?" Turbotax explains it this way. "The IRS offers a number of tax credits that you can take directly off your taxes rather than your income. If the credit is more than you owe in taxes, in some cases, you can claim the excess credit as a refund. The IRS lists the "additional child tax credit" and the "earned income tax credit" as examples; if you qualify for these credits, you can receive a refund even if you paid no taxes. To claim the credits, you have to file your 1040 and other tax forms." Perfectly legal and acceptable.

You need to stop with your repititious remarks about the federal government not helping states and municipalities. The Constitution does not prohibit "Uncle Sam" to give assistance to states, cities and towns.

Wayne, Wayne, Wayne, you can defend President George W. Bush all day long, but the proof is in the pudding, or in this case, the written memorandums by Richard Clarke. If President Bush had kept Clarke in the loop where he was allowed to do what he always did before, and that's to report DIRECTLY to the President, then the attacks on September 11th, 2001 may not have happened. There is too much evidence that Clarke provided to members of the Bush administration that could have prevented 9/11. So President Bush 43 did not do his job, and neither did others in his administration. No lies. All truth.

Everybody to you is a "hater," Wayne, when they disagree with a president. You've done it with Bush, and you do it with Donald Trump. Richard Clarke is not a liar, or a hater. What you have said is totally false. I hope you'll read my new column from July 21st, 2019 and comment there below that editorial. No hate. No lies. All truth.

History will never show "how great" President George W. Bush was because of 9/11 and because of The Great Recession. President Barack Obama will continue to increase with popularity as the years go by and historians will reflect his greatness.

President Obama's policies were first rate, and the Iran nuclear deal should have remained. America will suffer in the future for what Trump did with it and with the Paris Climate Agreement. Racism is a terrible, terrible problem in our country. Read my new column from July 21st and respond there regarding racism. As for the Affordable Care Act, 30 million Americans have health insurance who never did before President Obama...including me because of my pre-existing conditions. If Congress had agreed with the public option - which is what President Obama wanted - things would be even better. Vice President Joe Biden (who I hope will be President Biden on January 20th, 2021 after winning the election on November 3rd, 2020), will get us the public option and improve the Affordable Care Act. The ACA is not perfect as it is, but thank God for President Obama that America has it. And thanks to a Republican, the late, honorable Senator John McCain, the Senate was unable to repeal the ACA.

You can try to accuse President Obama of "lies," but they were not lies. Donald Trump has told more than 10,000 documented lies in two-and-a-half years. No president has ever, in our entire U.S. history, lied and lied and lied as Trump has done.

GBD

Gary we can stay with the top 1% who pay close to 40% of all personal Federal Income Tax while earning under 20% of all income, so shouldn’t they get close to 40% of any tax cut? It’s their money. As for the question of refund I know what the IRS calls it, to me it should be called what it is a handout or welfare, yes it is legal but that doesn’t make it acceptable.

ReplyDeleteThe Constitution “may not” prohibit the Federal government from assisting States but it is not there job or responsibility, why should the people in Pennsylvania or Ohio etc pay for the stupid mistakes of the people in New Orleans, Louisiana when you build a city below sea level what do you expect will happen, or in California when you build houses on cliffs that have mudslides and earth quakes why should the rest of the country pay for your stupid decisions? Your state let you build it’s your problem and that should go for all 50 states.

Gary, I really don’t think you want to assign blame about 9/11, it wasn’t President G W Bush who let Osama bin Laden build al-Qaeda, it was President G W Bush who stopped the CIA from taking bin Laden out when they had him in their rife sights, it wasn’t President G W Bush who said in 1993 when they bombed the World Trade Center that it was a criminal act not an act of war, it was the one who cared more about getting his jollies off instead of protecting America! Those are the facts, blame it on Bill Clinton!

The rest isn’t worth my time to type, Obama was a terrible President and if half the country was afraid of being called a racist he would never have been elected, he played the race card against Hillary in 08 and built on it in 12.

The response to the above reader will be in three parts.

DeletePART ONE OF THREE

In a word, the answer to your question is that the top 1 percent shouldn't get the tax cuts because in America it's always been where the rich help to pay for the poor. That's one of the reasons for taxes and why taxing the rich has to be for higher amounts than for people who make less money. The top 1 percent are the super rich, the billionaires. They can afford to be taxed higher. As I wrote in my column...America has a "so-called 'middle-class' and (they're) get(ting) knifed in the back. I say the 'so-called' middle-class today. There are the super-rich, the rich, the comfortable but careful, the people who barely squeak by, and the poor."

No Wayne, there are no "handouts." And welfare is perfectly appropriate and acceptable for people who need it. The U.S. government should help people who are unable to live the way they deserve to live. Yes, I said the way they "deserve to live." That is why minimum wage should increase to $16 an hour to start, with a gradual increase to $20 an hour over four years. Even at $800 for a 40-hour week is not good to truly survive and live for a single person in 2019.

We are all Americans. People who live in Pennsylvania don't identify themselves as "Pennsylvanians." They may say they "live" in Pennsylvania, or that they are "from" Pennsylvania, but they ARE...Americans. Americans help Americans, no matter what state they live in. Therefore, it is the responsibility for the people from all 50 states to pay taxes, and as such, sometimes their taxes will help the state they live in, and sometimes their taxes will help states that other people live in. THAT...is what America is about. Wayne, you can call the people in New Orleans or in southern California "stupid," but when they suffer a tragedy, they need to be helped. When Hurricane Sandy struck New Jersey (your state), and destroyed a great deal of homes and land in the southern part of the state, federal aid came to the rescue. Again, that's what America is about. Should nobody in New Jersey live on the shore? That's their choice. I lived in Florida, on a barrier island between the Atlantic Ocean and a river. My house was mere yards away from the ocean water. After going through several hurricanes, one where I had to evacuate, I personally would probably not ever live on the water again. But people have the right to do that should they so desire. And America, as a nation, and Americans, as people, should help others when there is a tragedy.

GBD

END OF PART ONE OF THREE

PART TWO OF THREE

DeleteWayne, your rhetoric about President Bill Clinton is a lie. Your comments have no facts. But here are the facts from FactCheck.org.

"Did Bill Clinton pass up a chance to kill Osama bin Laden? Probably not, and it would not have mattered anyway as there was no evidence at the time that bin Laden had committed any crimes against American citizens. Let’s start with what everyone agrees on: In April 1996, Osama bin Laden was an official guest of the radical Islamic government of Sudan – a government that had been implicated in the attacks on the World Trade Center in 1993. By 1996, with the international community treating Sudan as a pariah, the Sudanese government attempted to patch its relations with the United States. At a secret meeting in a Rosslyn, Va., hotel, the Sudanese minister of state for defense, Maj. Gen. Elfatih Erwa, met with CIA operatives, where, among other things, they discussed Osama bin Laden. It is here that things get murky. Erwa claims that he offered to hand bin Laden over to the United States. Key American players – President Bill Clinton, then-National Security Adviser Sandy Berger and Director of Counterterrorism Richard Clarke among them – have testified there were no 'credible offers' to hand over bin Laden. The 9/11 Commission found 'no credible evidence' that Erwa had ever made such an offer. On the other hand, Lawrence Wright, in his Pulitzer Prize-winning The Looming Tower, flatly states that Sudan did make such an offer. Wright bases his judgment on an interview with Erwa and notes that those who most prominently deny Erwa’s claims were not in fact present for the meeting. Wright and the 9/11 Commission do agree that the Clinton administration encouraged Sudan to deport bin Laden back to Saudi Arabia and spent 10 weeks trying to convince the Saudi government to accept him. One Clinton security official told The Washington Post that they had 'a fantasy' that the Saudi government would quietly execute bin Laden. When the Saudis refused bin Laden’s return, Clinton officials convinced the Sudanese simply to expel him, hoping that the move would at least disrupt bin Laden’s activities. In his 2004 testimony to the 9/11 Commission, Clinton stated that there had never been an offer to turn over bin Laden. It is clear, however, that Berger, at least, did consider the possibility of bringing bin Laden to the U.S., but, as he told The Washington Post in 2001, 'The FBI did not believe we had enough evidence to indict bin Laden at that time, and therefore opposed bringing him to the United States.' According to NewsMax.com, Berger later emphasized in an interview with WABC Radio that, while administration officials had discussed whether or not they had ample evidence to indict bin Laden, that decision 'was not pursuant to an offer by the Sudanese.' So on one side, we have Clinton administration officials who say that there were no credible offers on the table, and on the other, we have claims by a Sudanese government that was (and still is) listed as an official state sponsor of terrorism. It’s possible, of course, that both sides are telling the truth: It could be that Erwa did make an offer, but the offer was completely disingenuous. What is clear is that the 9/11 Commission report totally discounts the Sudanese claims. Unless further evidence arises, that has to be the final word." Let me repeat the last sentence above, Wayne, so you understand. "What is clear is that the 9/11 Commission report totally discounts the Sudanese claims. Unless further evidence arises, that has to be the final word."

GBD

END OF PART TWO OF THREE

PART THREE OF THREE

DeleteWayne, FactCheck.org goes on to say..."Ultimately, however, it doesn’t matter. What is not in dispute at all is the fact that, in early 1996, American officials regarded Osama bin Laden as a financier of terrorism and not as a mastermind largely because, at the time, there was no real evidence that bin Laden had harmed American citizens. So even if the Sudanese government really did offer to hand bin Laden over, the U.S. would have had no grounds for detaining him. In fact, the Justice Department did not secure an indictment against bin Laden until 1998 – at which point Clinton did order a cruise missile attack on an al Qaeda camp in an attempt to kill bin Laden. We have to be careful about engaging in what historians call 'Whig history,' which is the practice of assuming that historical figures value exactly the same things that we do today. It’s a fancy term for those 'why didn’t someone just shoot Hitler in 1930?' questions that one hears in dorm-room bull sessions. The answer, of course, is that no one knew quite how bad Hitler was in 1930. The same is true of bin Laden in 1996."

So those are the FACTS, Wayne. So do NOT blame President Clinton for 9/11. I've made my case, Wayne, and once again, if President Bush had listened to Richard Clarke, it's certainly quite possible that the attacks on 9/11 would never have happened.

Wayne, read my new column from July 21st. Your remarks about President Obama and racism are disgusting and totally unsubstantiated.

GBD

END OF PART THREE OF THREE